04 | The heart of Hafnia

| Type | Owned | Bareboated-in | Time chartered-in | Commercial management | Total |

| LR2 | 6 | – | – | – | 6 |

| LR1 | 28* | 4 | 3 | 41 | 76 |

| MR | 41 | – | 6 | 15 | 62 |

| Handy | 13 | – | – | 10 | 23 |

| Specialized | – | – | – | 17 | 17 |

| 88 | 4 | 9 | 83 | 184 |

* Including five LR1’s and one LR1 newbuild owned through 50% ownership in Vista Shipping Pte Ltd

Environmental efficiency is important in securing favourable contracts with high-quality customers. Hafnia’s fleet is part of our competitive advantage. Being young and well-maintained, our fleet reduces fuel consumption and operating cost while improving safety and vessel utilisation, hence maximising the quality of service we deliver to our customers.

In total, Hafnia’s owned, bareboat-in and time chartered-in fleet of 100 vessels has a carrying capacity of approximately 6.1 million dwt. The average age of the fleet is approximately 7.3 years (excluding newbuilds). A large part of our fleet has a modern eco-design that uses technological improvements to optimise speed, minimise fuel consumption and reduce emissions.

The average age of the global LR2, LR1, MR and Handy fleets are approximately 9.4, 11.3, 10.6 and 14.7 years respectively (source: Clarksons research, January 2021). The estimated useful lifespan of each vessel is 25 years.

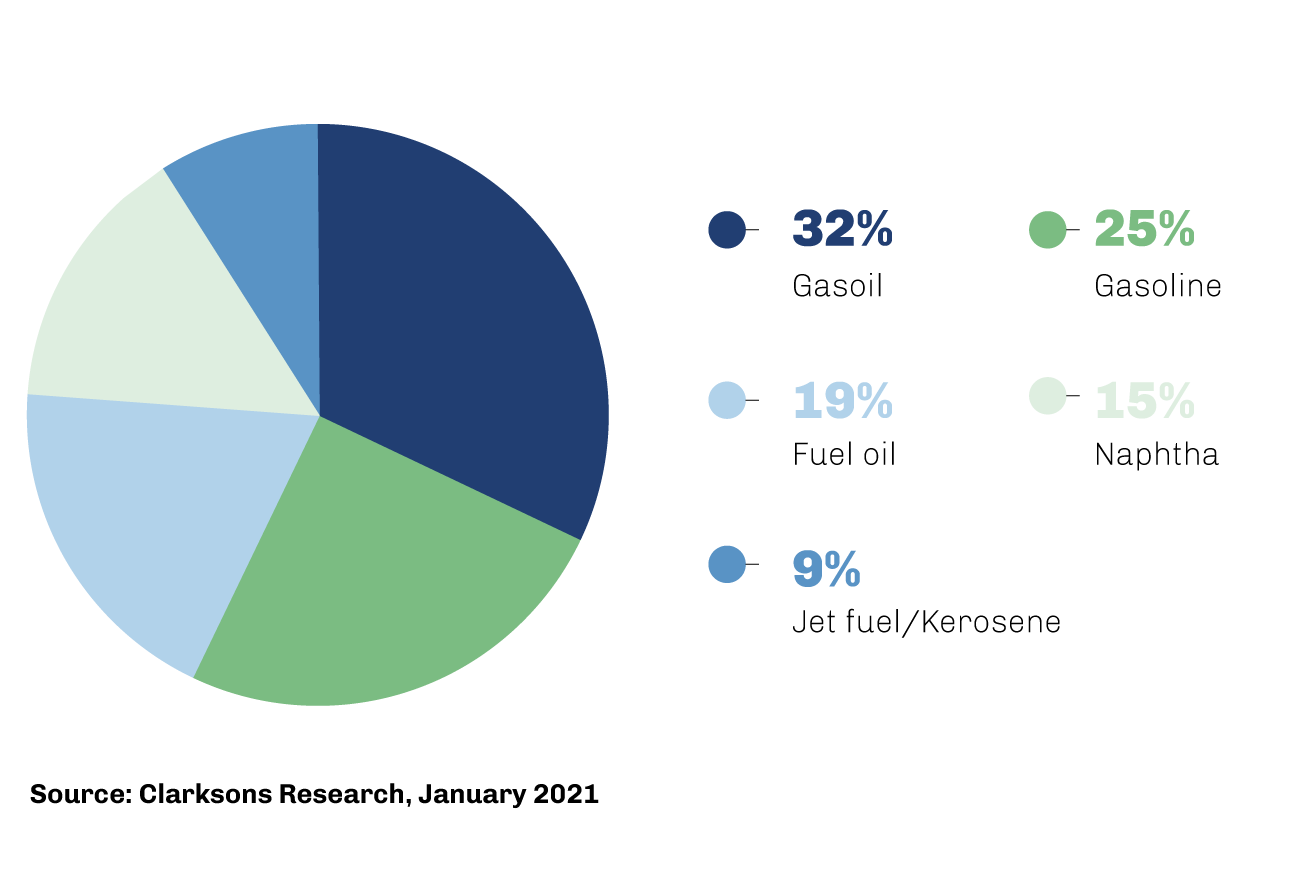

Products transported

The product tanker fleet can carry a wide range of oil and oil products, including gasoline, diesel, gas oil, naphtha, kerosene, vegetable oil, fuel oil, crude oil and chemicals.

In 2020, 32% of the global cargoes were gasoil, 25% were gasoline, 19% fuel oil, 15% naphtha, and 9% jetfuel/kerosene.

Employment and earnings

Hafnia employs its fleet within three of the four Hafnia pools, namely the Handy pool, the MR pool and the LR pool, or through longer chartered-out contracts.

Revenue from a vessel’s employment within a pool is influenced by the number of vessels in the pool, the number of days during which the vessels in the fleet operate and the freight rates that the pool earns, after adjusting for pool points. A vessel’s pool points reflect the earning potential of the vessel.

| Q1 2020 | Q2 2020 | Q3 2020 | Q4 2020 | Total | |

| Handy | |||||

|---|---|---|---|---|---|

| Vessels at the end of the period | 13 | 13 | 13 | 13 | 13 |

| Total operating days | 1,173 | 1,218 | 1,245 | 1,167 | 4,803 |

| Total calendar days (excluding tc-in) | 1,183 | 1,183 | 1,196 | 1,196 | 4,758 |

| TCE (USD per operating days) | 22,723 | 18,819 | 10,399 | 9,472 | 15,321 |

| OPEX (USD per calender day) | 6,306 | 5,928 | 6,599 | 6,522 | 6,340 |

| MR | |||||

| Vessels at the end of the period | 47 | 47 | 47 | 47 | 47 |

| Total operating days | 4,214 | 4,301 | 4,215 | 4,051 | 16,781 |

| Total calender days (excluding tc-in) | 3,731 | 3,731 | 3,772 | 3,772 | 15,006 |

| TCE (USD per operating days) | 21,960 | 22,497 | 12,709 | 10,836 | 17,089 |

| OPEX (USD per calender day) | 6,728 | 5,852 | 6,883 | 7,803 | 6,819 |

| Non-pool Panamax | |||||

| Vessels at the end of the period | 4 | 4 | 4 | 4 | 4 |

| Total operating days | 364 | 364 | 368 | 355 | 1,451 |

| Total calender days (excluding tc-in) | 364 | 364 | 368 | 368 | 1,464 |

| TCE (USD per operating days) | 20,996 | 30,991 | 8,393 | 8,640 | 17,283 |

| OPEX (USD per calender day) | 8,186 | 7,223 | 6,894 | 4,669 | 6,737 |

| LR1 | |||||

| Vessels at the end of the period | 26 | 26 | 26 | 25 | 25 |

| Total operating days | 2,327 | 2,309 | 2,287 | 2,297 | 9,220 |

| Total calender days (excluding tc-in) | 2,093 | 2,093 | 2,116 | 2,072 | 8,374 |

| TCE (USD per operating days) | 23,044 | 26,412 | 14,694 | 13,649 | 19,475 |

| OPEX (USD per calender day) | 7,181 | 6,542 | 6,937 | 7,830 | 7,123 |

| LR2 | |||||

| Vessels at the end of the period | 6 | 6 | 6 | 6 | 6 |

| Total operating days | 546 | 545 | 552 | 552 | 2,195 |

| Total calender days (excluding tc-in) | 546 | 546 | 552 | 552 | 2,196 |

| TCE (USD per operating days) | 23,762 | 27,465 | 27,702 | 27,108 | 26,514 |

| OPEX (USD per calender day) | 6,383 | 6,297 | 6,318 | 7,606 | 6,653 |

Technical and crewing

Hafnia has a fully integrated technical department that draws support and knowledge from external technical managers to manage maintenance, dry docking, marine vetting, security, and crew management. They ensure that the highest safety and environmental standards are maintained on board. The technical department is also working on developing IT solutions to run and maintain the fleet.

Strategy for 2021

Hafnia is making progress to lower the emissions profile of its fleet, but substantial changes take time, as significant investments in technological advancements are required. Hafnia follows all new technologies closely and is in constant dialogue with shipyards and technical suppliers regarding more sustainable solutions for retrofits and newbuilds, and methods to prove performance are being developed.

Hafnia may divest older tonnage to make room in the fleet for alternatives with ECO or dual-fuel type vessels, be they in the form of chartered-in vessels, vessels bought second-hand, or newbuilds.

Hafnia continues to maintain, improve and upgrade the existing fleet. For example, Hafnia reduces fuel consumption in its vessels through improved anti-fouling, engine room management, intermediate dry dockings, waste heat recovery, and optimising maintenance.

As further demonstrations of Hafnia’s commitment to sustainability, Hafnia has also acquired a 50% stake in two LR2 dual-fuel vessels chartered out to Total on long-term contracts. Moreover, Hafnia bought a stake in the Kalama methanol facility guaranteeing 19-year contracts to carry methanol from the US West Coast to Asia on methanol-fueled vessels, and has entered into sustainability-linked loan arrangements.

Purchase options and obligations

The below tables present an overview of the Group’s purchase options and obligations for its time chartered-in or bareboat-in vessels.

Options

USD million

| Name | Type | Year | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Orient Challenge | MR | 2017 | 31.90 | 30.30 | 28.70 | 27.10 | 25.50 | 23.90 | 22.30 | – | – | – |

| Orient innovation | MR | 2017 | 31.90 | 30.30 | 28.70 | 27.10 | 25.50 | 23.90 | 22.30 | – | – | – |

| Beagle | MR | 2019 | – | 38.00 | 35.75 | 34.25 | 32.75 | 31.25 | 29.75 | – | – | – |

| Basset | MR | 2019 | – | 38.00 | 35.75 | 34.25 | 32.75 | 31.25 | 29.75 | – | – | – |

| Boxer | MR | 2019 | – | 38.00 | 35.75 | 34.25 | 32.75 | 31.25 | 29.75 | – | – | – |

| Bulldog | MR | 2020 | – | – | 38.00 | 35.75 | 34.25 | 32.75 | 31.25 | 29.75 | – | – |

| Sunda | LR1 | 2019 | – | 46.00 | 44.00 | 42.00 | 40.00 | 38.00 | 36.00 | – | – | – |

| Karimata | LR1 | 2019 | – | 46.00 | 44.00 | 42.00 | 40.00 | 38.00 | 36.00 | – | – | – |

| Hafnia Africa | LR1 | 2010 | 24.00 | 19.60 | 17.10 | 14.60 | 12.10 | 9.60 | 8.00 | 5.50 | 3.00 | – |

| Hafnia Australia | LR1 | 2010 | – | 21.00 | 19.00 | 17.00 | 14.90 | 12.90 | 10.90 | 8.90 | 6.35 | – |

| Hafnia Asia | LR1 | 2010 | 23.70 | 22.86 | 21.25 | 19.38 | – | – | – | – | – | – |

| Hafnia Artic | LR1 | 2010 | 24.65 | 23.77 | 22.10 | 20.15 | – | – | – | – | – | – |

Obligations

USD million

| Name | Type | Year | 2021 | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Hafnia Australia | LR1 | 2010 | – | – | – | – | – | – | – | – | – | 4.20 |

| Hafnia Asia | LR1 | 2010 | – | – | – | – | 17.25 | – | – | – | – | – |

| Hafnia Arctic | LR1 | 2010 | – | – | – | – | 17.94 | – | – | – | – | – |

Tonnage chartered-in and out

Tonnage chartered-in 31 December 2020

| 2021 Days | 2021 USD/day | 2022 Days | 2022 USD/day | 2023 Days | 2023 USD/day | 2024 Days | 2024 USD/day | 2025 Days | 2025 USD/day | 2026 Days | 2026 USD/day | |

| Handy | – | – | – | – | – | – | – | – | – | – | – | – |

| MR | 2,190 | 15,950 | 2,190 | 15,950 | 2,190 | 15,950 | 1,698 | 15,943 | 398 | 15,908 | – | – |

| LR1 | 1,094 | 16,837 | 840 | 17,997 | 730 | 18,750 | 427 | 18,750 | – | – | – | – |

| LR2 | – | – | – | – | – | – | – | – | – | – | – | – |

Tonnage sales and lease back 31 December 2020

| 2021 Days | 2021 USD/day | 2022 Days | 2022 USD/day | 2023 Days | 2023 USD/day | 2024 Days | 2024 USD/day | 2025 Days | 2025 USD/day | 2026 Days | 2026 USD/day | |

| Handy | – | – | – | – | – | – | – | – | – | – | – | – |

| MR | – | – | – | – | – | – | – | – | – | – | – | – |

| LR1 | 1,460 | 6,811 | 1,460 | 7,240 | 1,460 | 7,718 | 1,464 | 7,663 | 1,113 | 7,574 | 730 | 7,547 |

| LR2 | – | – | – | – | – | – | – | – | – | – | – | – |

Tonnage chartered-out 31 December 2020

| 2021 Days | 2021 USD/day | 2022 Days | 2022 USD/day | 2023 Days | 2023 USD/day | 2024 Days | 2024 USD/day | 2025 Days | 2025 USD/day | 2026 Days | 2026 USD/day | |

| Handy | 525 | 14,695 | 252 | 15,625 | – | – | – | – | – | – | – | – |

| MR | 1,358 | 15,764 | 33 | 14,250 | – | – | – | – | – | – | – | – |

| LR1 | 234 | 21,228 | 39 | 22,022 | – | – | – | – | – | – | – | – |

| LR2 | 1,552 | 25,789 | 920 | 25,525 | – | – | – | – | – | – | – | – |