06 | The Product tanker market

Analysis Creates Expertise

2021 Outlook

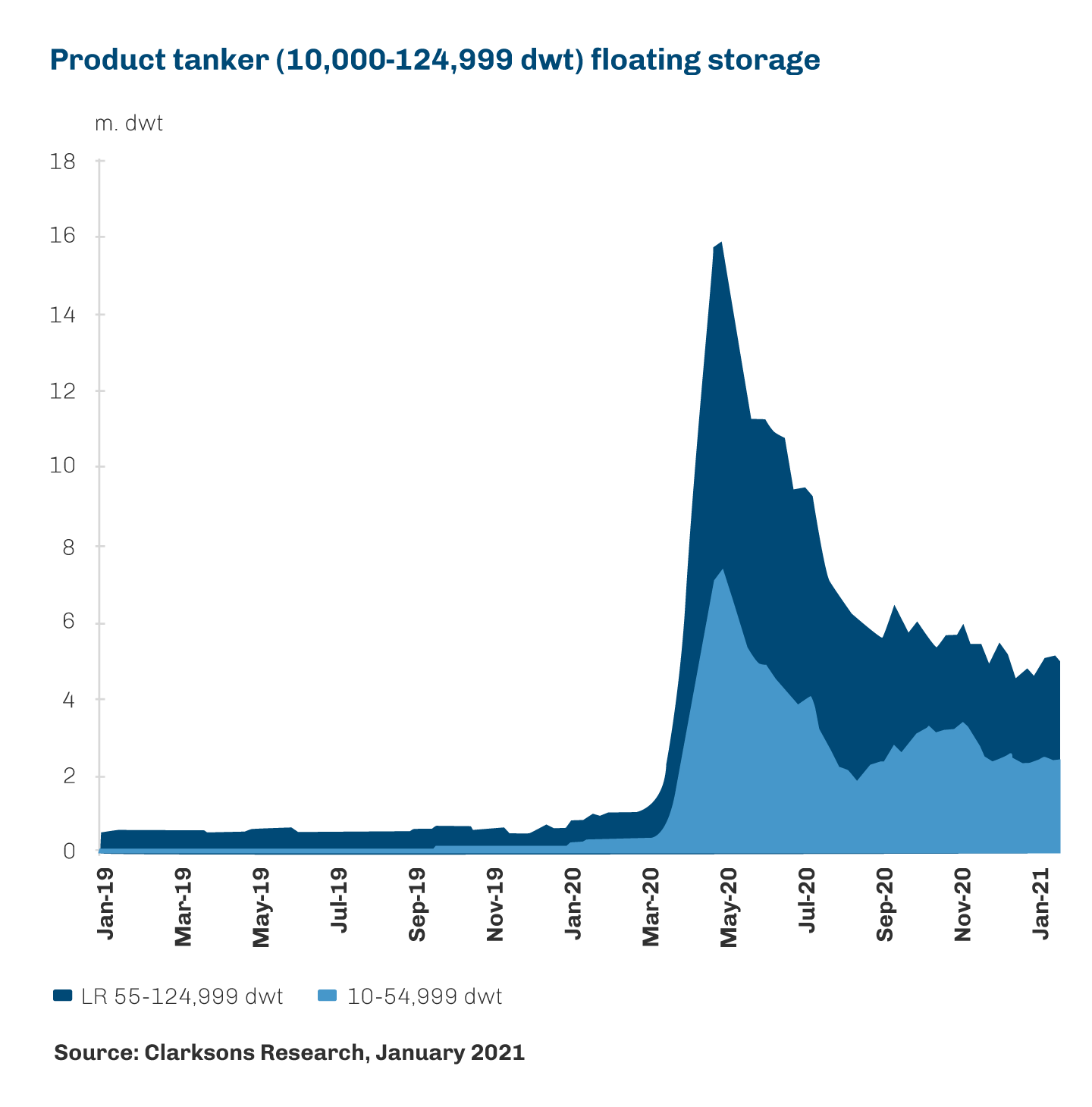

The outlook for the product tanker sector in the first half of 2021 appears challenging, with Covid-19, inventories and lack of consumption expected to continue to weigh on market conditions. Against a backdrop of ongoing negative impacts on oil demand from renewed lockdowns in key regions and a resultant pressure on refinery throughput, seaborne oil products trade currently remains subdued. In the first half of 2021, market pressure is further expected from the continued easing in floating storage, on top of the underlying global fleet expansion of 2.0% in the product tanker sector. However, the latest trade projections suggest a bounce-back in seaborne products trade in the second half of 2021 as oil demand recovers while inventories return to normal. Combined with a rebound in demand, seasonal uplift is expected towards the end of the year. A potential logistical disruption as storage unwinds, whilst inefficiencies from port delays, repositioning, and reactivation could also cause “windows” of rate improvement.

Although Covid-19 vaccination programmes have bolstered hopes of improved oil demand levels later in 2021, there remains major uncertainty in the outlook, with concerns of new Covid-19 variants and continued high case numbers in some regions.

According to Clarksons Research, global oil demand is projected to rebound by c. 6% in 2021 to 97.1 million barrels per day (following a sharp decline of 8.8% in 2020), with improving economic activity and easing of mobility restrictions relative to 2020 (aided by the rollout of vaccines across major regions) projected to provide support, particularly to gasoline and diesel demand. According to IEA, oil demand in the fourth quarter of 2021 is expected to be 99.2 million barrels against 100.6 million barrels in the last part of 2019.

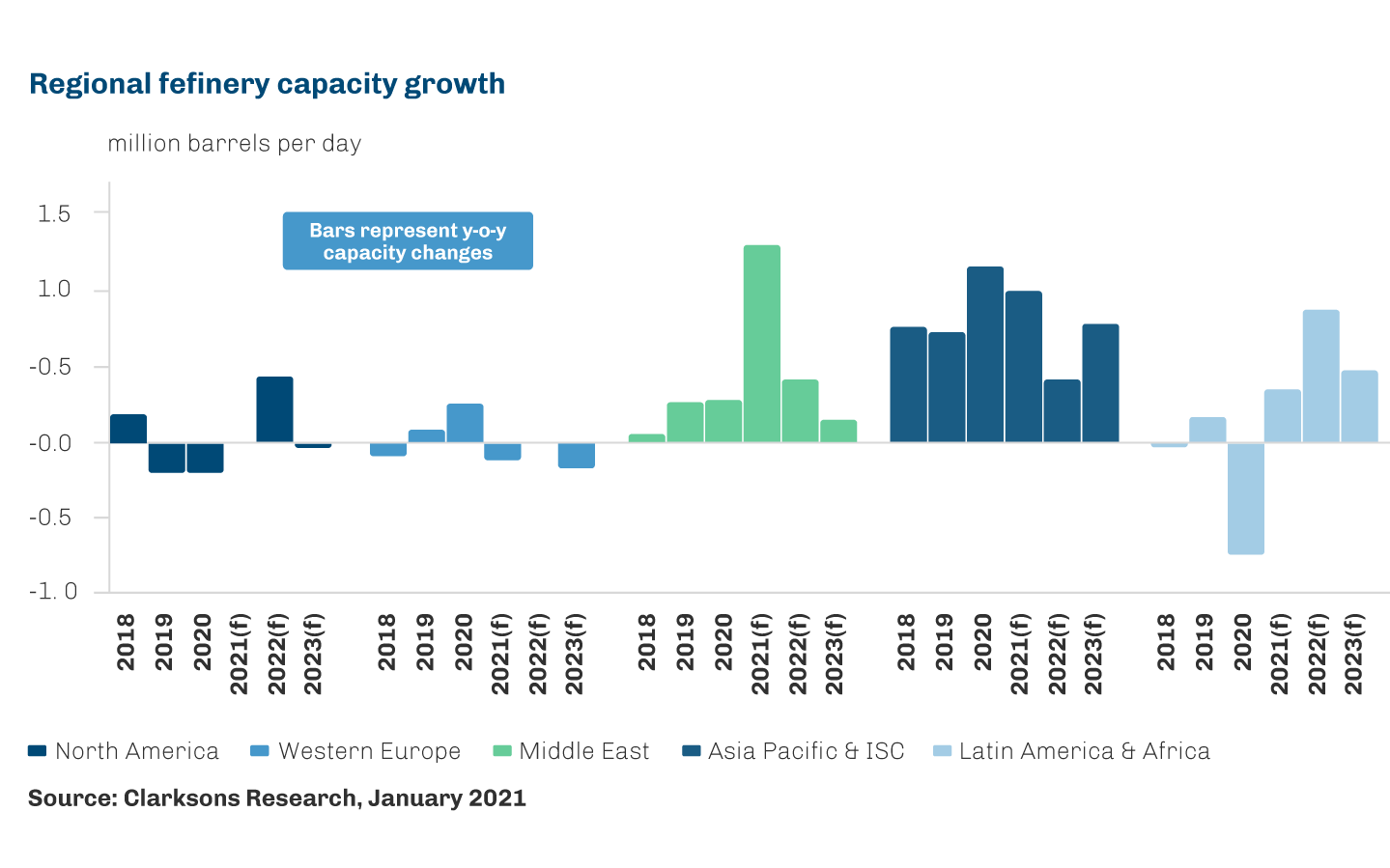

Refinery throughput at the start of 2021 will be well below the pre-Covid-19 levels but is expected to catch-up from the middle of the year as oil demand recovers. IEA currently forecasts the bounce-back in global refinery throughput in 2021 at an average of c. 6% y-o-y following a decline of 12% in 2020. In the first half of 2021, European throughput is projected to remain under pressure as refiners continue to struggle with weak margins. These margins are likely to remain low until inventories are drawn down, oil demand recovery in the region picks up pace, and significant volumes of capacity remain offline either temporarily or permanently. Around 1.2 million barrels per day of global refinery capacity was closed, mothballed or converted in 2020 (not including capacity temporarily offline due to impacts of Covid-19), with an additional 0.7 million barrels per day announced for 2021 (potentially rising to over 1.0 million barrels per day). Whilst new export-oriented capacity is slated to start up this year and next, this is likely to exacerbate the existing surplus of refining capacity.This would force inefficient refineries near to consumption areas to close down, thereby improving tonne-mile demand.

In line with improving oil demand and refinery runs, seaborne products trade is expected to see improvement in 2021, with volumes growing by 6% y-o-y following the disruption in 2020. The seaborne volumes are expected to grow as oil demand and refinery runs improve throughout the year. However, trade volumes are projected to remain below 2019 levels with the expectation that impacts from Covid-19 on demand and trade in some fuels (e.g. jet) will take time to ease. However, total product tanker tonne-mile trade is in 2021 projected to exceed growth in terms of tonnes, expanding by c. 7%, partly as disruption to trade flows continues to raise average haul.

Vessel prices

Product tanker asset values have also fluctuated over time, together with fluctuations in the charter market. The significant fall in newbuild prices between 2008 and 2010 can primarily be seen as the result of lower global contracting activity. Newbuild prices have not recovered, at least as of January 2021. Prices increased in 2013-14, softened across 2015-16 and rose again between mid-2017 and September 2019, reaching USD 36.5 million for an MR vessel, but this price is still below the mid-2008 level of USD 53.5 million. Due to low ordering activity, 2021 then saw a softening of the price to USD 34 million at the end of January 2021.

Trends in refining capacity

Trends in refinery capacity and throughput levels are also a key driver of seaborne products trade patterns. At the end of 2020, global refinery capacity totalled an estimated 102 million barrels per day. Over a third of this capacity is located in Asia, and significant capacity is also located in the US and Europe.

Global refinery capacity has expanded steadily over time in order to meet the continued growth in consumption of oil products and has expanded by over 9 million barrels per day since 2010. Refinery capacity additions in Asia, particularly China, have been a key driver of this expansion, with China adding 4.3 million barrels per day of capacity in this period. Growth in Middle Eastern refinery capacity has also been a key driver of expansion in the global refining industry, with the construction of large-scale export-oriented plants such as YASREF and Jubail in Saudi Arabia, which have supported long-haul products trade to Asia and Europe. Meanwhile, the refining industries in Europe, Japan and Australia have contracted as outdated capacity has been closed.

Further expansion is also projected in China, in particular in the independent refining sector. The product trade is expected to see new long-range trading patterns as 1.3 million barrels per day of export-oriented refinery capacity comes on stream in the Middle East in 2020. This is likely to lengthen tonne-miles for the product market.