06 | The Product tanker market

Analysis Creates Expertise

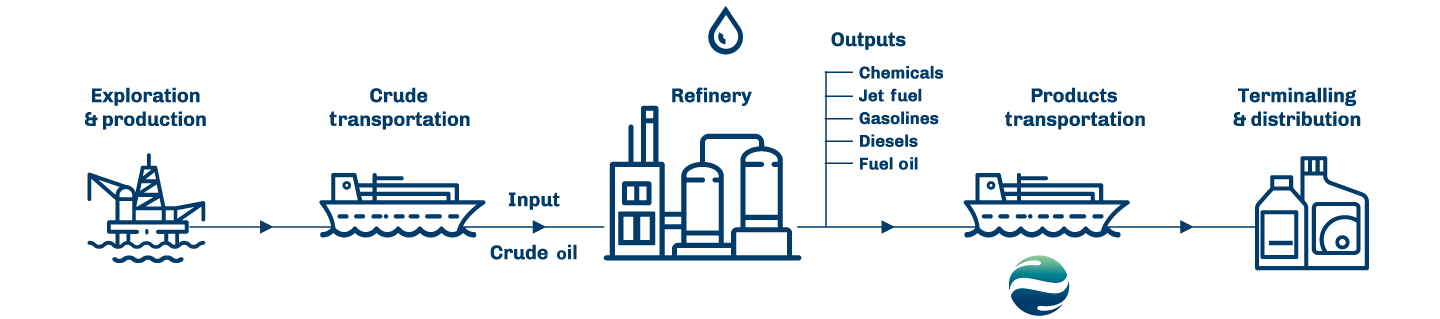

The product tanker industry

Is cyclical and volatile. Changes in the global supply and demand for tanker capacity, and for oil and oil products, result in fluctuations in achievable freight rates.

The charter market is highly competitive and based primarily on the offered charter rate, the vessel’s location and technical specification, and the reputation of the vessel and its manager.

As this simplified tanker market overview shows, the charter rates and product tanker capacities depend on several factors:

- The Number of new tanker vessels delivered, undergoing repair, and the number of vessels being scrapped

- Refiniery throughput

- The Prices of oil, oil products and bunker

- Environmental regulations

- Geopolitics

Crude tankers transport crude oil from points of production to oil refineries or storage locations. Product tankers can carry both refined and unrefined petroleum products, including crude oil, fuel oil, vacuum gas oil (dirty products), and gas oil, gasoline, jet fuel, kerosene and naphtha (clean products).

Freight rates for product tankers trading under spot charters are susceptible to fluctuating demand and supply of vessels, and rates are consequently volatile. Rates are also strongly affected by seasonal fluctuations in demand from end consumers. While trends in the product tanker market are heavily impacted by product tanker supply and demand trends, market conditions have also correlated with crude oil tanker market developments, reflecting that crude and product tankers have the potential to act as ‘swing tonnage’ between the dirty and clean markets.

In 2020, the average product flow transported at sea was approximately 20 million barrels per day, down from 22.4 million barrels in 2019. There was a similar reduction in average crude flow of 37.2 million barrels per day in 2020, down from 40.3 million barrels in 2019.